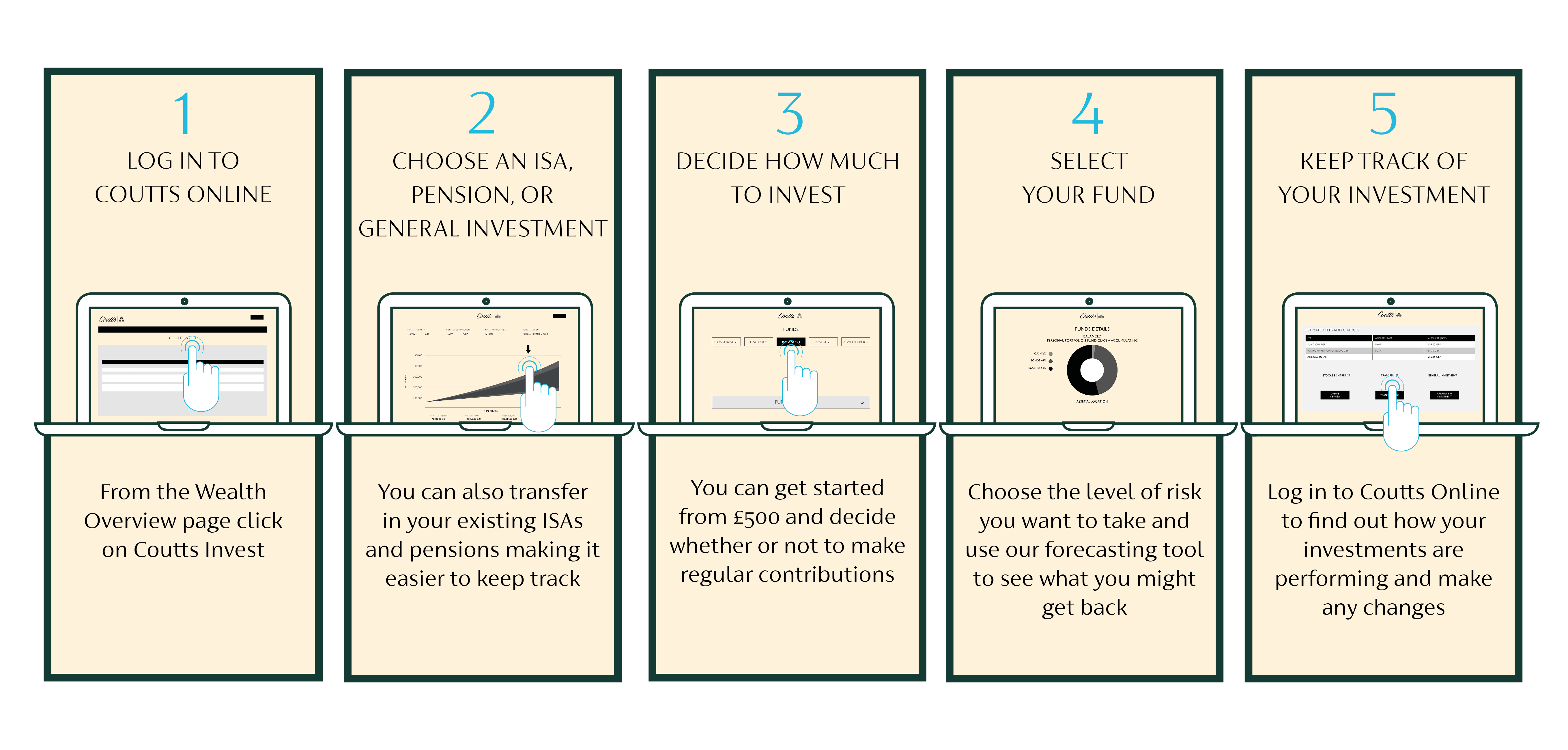

Invest in just a few clicks

Coutts Invest gives you a simple way to invest your money for the future without the need for advice. With just a few clicks you can invest in one of five funds actively managed by our experts. Decide how much you want to put in and how adventurous you want to be, and leave the rest to us.

You can use it to put all your pensions and ISAs in one place for convenience, or simply use it to make a general investment. Start from as little as £500 with the option of regular contributions from £50 a month.

If you’re a client with access to Coutts Online, our online banking service, you can start straight away. If you’re not yet registered for online banking, call us on 020 7770 0000 and we’ll set you up in just a few minutes. Alternatively, speak to your private banker.

The value of investments can go down as well as up and you may not get back the full amount you invest.

The total annual cost for investing through Coutts Invest comprises a platform fee, a fund fee known as the Ongoing Charges Figure (OCF) and transaction costs.

Our fees are reviewed from time to time and we will let you know in advance if there are any changes that will affect you.

To understand our fees and charges in more detail please refer to the Coutts Invest Fee Tariff within Coutts Online.

Platform fee:

The platform fee varies depending on the value of your investment – see the table below for how it works:

| Tier | Value of your Investment |

Platform fee Rate | Ongoing Charges figure | Transaction Costs |

|---|---|---|---|---|

| 1 | £0 to £250,000 | 0.35% | 0.60% Max | 0.07% highest |

| 2 | >£250,000 to £500,000 | 0.25% | 0.60% Max | 0.07% highest |

| 3 | >£500,000 | 0.10% | 0.60% Max | 0.07% highest |

Ongoing Charges Figure (OCF):

Each fund has its own OCF which will vary depending on the costs of the underlying investments. This will not be more than 0.60%. The OCF is made up of an annual management charge and other expenses relating to the underlying investments.

Transaction Costs:

This is the cost of buying and selling shares and other investments that make up the fund. The fund manager estimates, based on actual past costs, that the highest costs that will be incurred for any of the available funds will be 0.07% of the value of the fund each year. These costs will be deducted by the fund manager from the fund's assets.

It is important to know that our non-advised service through Coutts Invest does not provide investment advice or recommendations. The value of investments can go down as well as up, so you could get back less than you invest. Your capital is at risk. If you are unsure about an investment, you may wish to seek personal financial advice. If you have higher priority needs you should consider these ahead of an investment in Coutts Invest.